- 11 JUN 2019

UPDATE ON GOVERNMENT’S STRENGTHENING OF THE ENERGY SECTOR

Madam Speaker, I have been authorized by Cabinet to make the following statement to this Honourable House and I thank you for the opportunity so to do.

Madame Speaker as has been previously outlined on numerous occasions, the country’s energy sector in September 2015 was not in a good place. There had been neglect of the gas contracts on both the upstream and the downstream sides and the country faced billions of dollars in claims and significant shortfalls of gas supply.

In March 2018, the Government held the first public account of the energy sector of Trinidad and Tobago titled “Spotlight on Energy”. The objective was to provide the people of Trinidad and Tobago, the resource owners, with an account of the state of the sector and the plans for the future.

Madam Speaker, it is important to note that the main criticism to the Spotlight on Energy came from the opposition, the United National Congress (UNC) and certain members of the Energy Chamber. Both the UNC and the members of the Energy Chamber accused the Government of being anti-investment and pursuing action that would constitute a violation of the sanctity of contracts executed with the International Oil Companies (IOCs). The suggestion was that the revelations at the Spotlight would result in the multinational oil companies declining to further invest in Trinidad and Tobago. This suggestion was not surprising and it was uninformed. The Government immediately upon assuming office in late 2015 had been working assiduously on the energy sector, and in particular, the relationships with the international players in the sector. Under the leadership of the Prime Minister we had been building the platform of mutual respect, and an ability to sit in the same room as equals, with these sophisticated multinational companies.

The Spotlight was held against a backdrop of an inadequate economic return from the exploitation of our natural gas resources. The stark reality of revenue foregone particularly from LNG was revealed in the Gas Master Plan produced by UK Consultants Poten and Partners.

Poten and Partners in the Gas Master Plan advised that it was arguable that Trinidad and Tobago had been denied the full benefit of its revenue entitlements. They deduced that the commercial and contractual structures of the ALNG trains had been such, that little of the benefit from high global LNG prices had flowed back to the Government, and therefore the citizens of Trinidad and Tobago, in the period under review of 2010 to 2014. Poten estimated that the country lost up to US$6Bn annually from transfer pricing practices during the period of 2010 to 2014.

The Government viewed this revelation with great concern. While the Government welcomes and encourages investment, we are of the belief that there must be an equitable sharing with the resource owner. According we took the position that the people of Trinidad and Tobago, as the owners of the country’s hydrocarbon resources, are entitled to a fair economic return from their exploitation. The Government gave an undertaking to the population, in March 2018, that it would take steps to ensure that the inequity that prevailed in the domestic LNG business would be rectified.

To this end, the Government engaged the major upstream companies BPTT, the major supplier of natural gas, and Shell, the major LNG off-taker and a supplier of gas, and said that the status quo in relation to LNG marketing arrangements could not be maintained and we would like to negotiate a new framework that was more beneficial to T&T.

Both Shell and BP have committed to substantial investment in the upstream of Trinidad and Tobago. BPTT and Shell together currently produce 2.8 billion cubic feet per day of natural gas, which is approximately three-quarters of the total gas production of 3.8 billion cubic feet per day. It was therefore in the interest of all parties to arrive at a mutually acceptable solution with respect to the revenue accruing from the marketing of LNG. Both BPTT and Shell acceded to Government’s request to review the marketing arrangements for ALNG Train 1, which expired in April 2019, and to discuss the arrangements for ALNG Train 2, Train 3 and Train 4.

In April 2018, a Government Team led by the Hon. Prime Minister Dr. Keith Rowley and including Minister Stuart Young and myself met in separate discussions in London with Shell and BP to advance the matter of improving the Country’s position. Arising from these discussions both Shell and BP agreed to establish empowered teams to engage Government separately on LNG marketing arrangements, gas related issues and other important issues raised by the companies.

The GORTT Team entered into negotiations with BPTT in August 2018 after a few months of preparations, which included, reviewing the complex legal positions and planning our strategies.

The first part of Phase 1 of the negotiations with BPTT was completed and resulted in the approval of the ALNG Train 1 marketing arrangement (which contained a significant increase in revenue to the Government, based on a new formula and LNG cargos for NGC, for the first time), the extension of BPTT’s South East Coast Galeota Licence (which led to the sanctioning of the Cassia project), settlement of the legacy royalty gas issue and NGC’s domestic gas shortfall. On December 14, 2018, Government and BPTT executed the Agreement with respect to the first part of the Phase 1 issues. This was followed by a payment by BPTT of approximately TTD$1.0 billion as settlement of the legacy issues of royalty gas and an interim payment to NGC on its domestic gas shortfall.

The negotiations with Shell began in August but were deferred to December 2018. However, in the interim, Shell as a major shareholder (46%) of ALNG Train 1 was an integral part of negotiations with BPTT on the marketing arrangements for Train 1. Arising from these negotiations a pricing formula for (Train FOB 1 price) that comprised one-third Brent, one-third UK NBP (National Balancing Point) and one- third JKM (the Asian LNG Market price as set by Japan Korea Marker) and which included the fixing of regasification and shipping costs, were agreed to by BPTT and Shell and accepted by the other ALNG 1 shareholders CIC and NGC. This new marketing arrangement was projected to provide Government with significant incremental revenues of approximately US$118 million (TT$800 million) per year. Whilst there has been an unforeseen delay in the life extension of Train 1 due to BPTT’s concern about its availability of gas for the Train, the shareholders are due to meet in June 2019 to determine the way forward.

The Shell specific issues were centered around Atlantic LNG marketing arrangements for Trains 2, 3 and 4 and its upstream operations.

LNG consumes in excess of 50% of the country’s natural gas production and was identified by Poten and Partners as the sector attributable for substantial value loss experienced by the Trinidad and Tobago. Shell is the majority off-taker in the LNG Trains with 68 % in Train 2, 73% in Train 3 and 51.1% in Train 4. Its LNG contract for Train 2, expires in 2022, Train 3, in 2023, and Train 4 in 2027. BP is the other significant shareholder in Trains 2, 3 and 4.

Consequent on Government’s push for an improved revenue stream and after months of complex and challenging negotiations, there was agreement that Shell would enhance the revenue to the Government, these enhancements are estimated at approximately US$944.7 million over the period 2018 to 2027, i.e. before the expiry of the agreements for Trains 2, 3 and 4.

It was also agreed that in Phase 2 of the negotiations the issue of restructuring of the four (4) LNG Trains into a single Unit would be the focus. The Government will be seeking to increase its shareholding throughout Atlantic LNG. At present Government through NGC has a 10% equity holding in Train 1 and an 11.1% equity holding in Train 4, but none in Trains 2 and 3.

Shell through its investment in the redevelopment of its East Coast Marine Blocks E, 5a and 6b has seen an increase in its gas production from an average 500 mmcf in 2017 per day to currently 750 mmcf per day. The Production Sharing Contracts for these blocks expire over the period 2022 to 2026. To facilitate the continued production from these Blocks Shell requested an extension of the PSCs, this formed part of Phase 1 of the Shell negotiations.

Government eventually agreed to the extension of the PSCs to 2030. It was also agreed to use the new Train 1 FOB price in future investments, which will provide improved and increased revenue to Government.

Shell also requested an extension of its NCMA- I PSC which expires in March 2022. Shell requested the extension of the terms of the PSC to facilitate continued gas production and access to future projects such as Dragon Project and the Colibri Project. Government agreed to the extension. It was also agreed to use the new Train 1 Formula in further investments, which again will provide increased revenue to Government. In addition, we negotiated that subject to projected available facility capacity, GORTT will be entitled to utilize up to 50% of NCMA infrastructure capacity with no liability for any historic capital cost. There will be an equitable sharing of operational expenses and any new capital cost.

In keeping with its investment programme, Shell has embarked on the development of its Colibri and Barracuda Projects. For the Barracuda Project (Block 5c) first gas is projected for 2020. First gas from the Colibri project (Block 22 and NCMA-4) is projected for 2021.

The Government and Shell also agreed that gas supplied from these PSCs and any newly sanctioned PSCs for the production of LNG will be based on the new Train 1 FOB formula. It is estimated that the value of approximately US$3.3 billion will accrue to the Government from Barracuda Project and Colibri projects over the period 2020 to 2029.

In relation to downstream activity the Government and Shell agreed on an equitable allocation of a gas supply between the domestic market (sales to NGC) and gas exports (LNG).

Another major outcome of these negotiations has been the resolution of ambiguity in the interpretation of contractual arrangements between the Government and Shell. A consequence of varied interpretation of these arrangements has been a suite of claims raised by the Ministry of Energy and Energy Industries and NGC, and Shell. In charting the way forward a zero settlement was agreed for all such claims except those not in dispute and areas of ambiguity were resolved, and Shell agreed to make a payment to GORTT without any admission of liability.

The outcome of these Phase 1 negotiations with Shell resulted in an agreement to pay the Government approximately US$397 million to the end of 2019 and the parties are moving onto Phase 2 of the negotiations, which surround the restructuring of Atlantic LNG.

The agreement on the upstream issues has also cleared the way for the finalization of a new Shell’s gas supply contract with NGC.

The finalization of the negotiations with Shell and BP has been a major achievement. The impact will be redound to the benefit of the country with improved revenues and increased upstream activity resulting in a stable and improved gas supply.

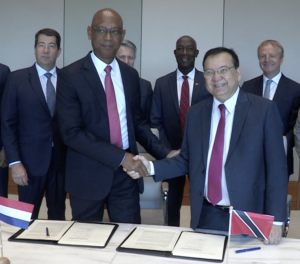

The Heads of Agreement with Shell embodying the above issues was signed on Wednesday 29th May 2019 in The Hague, Netherlands at the Head Office, Royal Dutch Shell, Plc. and will be followed by definitive agreements which will be finalized over the next two months.

Madam Speaker, these have been landmark agreements which will benefit the people of Trinidad and Tobago. I wish to acknowledge the strategic direction of Dr The Honourable Keith Rowley, Prime Minister of Trinidad and Tobago whose guidance enabled a successful and positive outcome to the negotiations. I wish also to thank members of Government’s Empowered Team which included the Honourable Stuart R. Young, Minister in the Office of the Prime Minister, Minister of National Security and Minister of Communications, advisers US Attorneys White and Case and UK Consultants Poten and Partners.

Madam Speaker, it would be amiss of me, if I did not express sincere thanks to the IOCs for the professional manner in which the negotiations were conducted and their appreciation of our concerns. This led to agreements which are to our mutual benefit.

As part of the continuing development of our relationship with the IOCs, the opportunity was taken to meet the decision makers at the energy capitals of the world. Hence our visits to the Hague where we met the hierarchy of Shell, in London- BP, and in Houston, BHP and EOG Resources.

Madam Speaker, contrary to the negative assertions by our detractors, all of the IOCs, that is Shell, BP, BHP and EOG have assured of continued investment in the upstream in Trinidad and Tobago. It is this commitment that has resulted in an increase in gas production from 3.3bcf per day in 2016 to the current rate of 3.8 bcf per day.

In closing, this Government has always stated that it welcomes investment but that the resource owner must enjoy a fair economic rent. Through our efforts, this is now clearly understood by the IOCs and has translated to the economic gains that we have achieved. These benefits will accrue to the people of Trinidad and Tobago. This is in keeping with the commitment of this administration to work for and on behalf of the people of Trinidad and Tobago.

Madam Speaker, I thank you.